Reshoring: The Impact for Logistics Providers – Frank Lange

Interest in reshoring and near-shoring has more than tripled since 2010 as manufacturers scramble to adapt to shifting demand and supply patterns across the globe, according to a recent survey by the Boston Consulting Group. With China’s cost advantage eroding in many industrial sectors, many companies are reconsidering their initial business case for offshoring their manufacturing and are taking a hard look at evolving demand markets, supplier and R&D platforms and technology solutions which are driving significant changes in their supply chains. The potential for shifting manufacturing back to the US also presents tremendous opportunities, once thought to be forever lost, for logistics providers seeking growth in a slowly recovering economy.

Key drivers for Reshoring

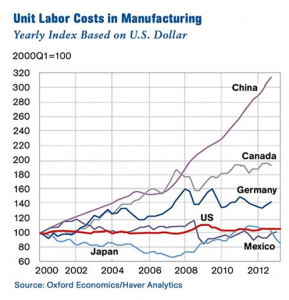

Most proponents of Reshoring focus heavily on rising production costs in China and “economic patriotism” in their arguments to bring manufacturing back to the US. The reality, however, is far more complex. Costs are a major factor, to be sure. Wage inflation, averaging close to 35% per year, has been a substantial concern across all industries in China, particularly in the key manufacturing regions of Shanghai and Guangzhou.

At the same time, actual labor cost remains lower relative to the US, and not all industries or individual companies will see the same benefits for reducing their China presence. There are, however, other factors in play that can help identify those particular industries that may benefit most by reconsidering their reliance on China for low cost production.

- Incentives to many manufacturers in China have significantly eroded or have disappeared altogether, impacting margins for companies that once relied on them.

- The adoption of LEAN methodology and the technology to rapidly apply product design changes have made many companies more agile and responsive to their US consumer base by being closer to home.

- Energy intensive industries are paying close attention to low energy costs in the US which have contributed heavily to closing its competitive gap with China.

- With cost differentials narrowing, US advantages in infrastructure, productivity and quality, as well as intellectual property and regulatory protections, are becoming more pronounced for higher end manufacturers.

The Opportunity for Logistics Providers and Their Customers

As manufacturers begin to assess their geographic strategy, significant opportunities will present themselves for US logistics providers. Unlike many major strategy shifts, this one is focused almost exclusively on the supply chain itself, giving providers the opportunity to take center stage in the discussion. A proactive, targeted strategy would accomplish the following:

- Present new opportunities to further leverage domestic networks, infrastructure and market strengths for new outsourcing capacity.

- Open the door to proactively and strategically add value to new stakeholders in customer organizations.

- Enhance a provider’s profile as a strategic thought leader with global accounts.

Manufacturers assessing a change in their geographic strategy would equally benefit:

- Leverage the opportunity to leverage a trusted supply chain partner to evaluate the viability of near or Reshoring.

- Leverage an existing supply chain partner familiar with historical perspectives and stakeholders for streamlined data gathering and current state assessment.

- Increase confidence and risk mitigation on execution with a known partner.

- Develop a strong business case with reliable data and a grounded understanding of the unique characteristics of its supply chain.

While it’s doubtful that China will lose its manufacturing advantage in the near term, it is clear that the current evolution of global supply chains will continue and manufacturers and shippers will continue to seek advantages from it. Manufacturers like Apple and GE have already begun to Reshore product lines where appropriate and Walmart has announced a commitment to direct over $250 billion of its procurement spend to US-manufactured product over the next 10 years.

Now might be a good time for US providers and their customers to have this discussion…

Originally published on Blue Silk Consulting website on September 24, 2014