The History and Future of Manufacturing in America and Mexico

By Daniel Domsky

By Daniel Domsky

The United States and Mexico share one of the world’s largest and most significant economic partnerships. In early 2023, both countries became their largest trading partners. An important part of the growth in their development is rooted in the manufacturing sector. In the United States, the manufacturing industry contributed 11.4% of the total Gross Domestic Product(GDP) in 2023. In Mexico, the manufacturing industry accounted for 21.47% of the total GDP. In addition, the manufacturing sector accounts for the highest growth of Foreign Direct Investment(FDI) in Mexico. While this economic sector accounts for a small percentage of GDP, manufacturing has a magnifier effect, creating greater economic growth than other industries. People employed in manufacturing spend their wages locally on food, rent, entertainment, and other services. For every peso or dollar earned by a manufacturing worker, the magnifier effect is approximately 4x for the local community.

Growth and Development in the 20th Century

Economic, political, and technological factors shaped the evolution of the manufacturing industry in the United States and Mexico. After the 1913 introduction of the production line by Henry Ford, the United States transformed the manufacturing sector through a surge of production capacity technological innovation, and supply chain management. This surge includes Toyota adapting Just-In-Time Manufacturing, (JIT), Demming’s Total Quality Management, Lean Manufacturing techniques, and more recently, 3D printing, advanced machine tools, IoT, and the use of digital twins and AI.

In Mexico, the manufacturing industry gained significant traction in the mid-20th century. This development was initially driven by import substitution industrialization (ISI) policies (high tariffs, subsidies, economic favoritism, and widespread state ownership and management) to reduce dependency on foreign goods. In addition, the sector’s growth accelerated with the creation of the Border Industrialization Program (“Programa de Industrialización Fronteriza”) in 1965 which established the “maquiladoras” (assembly plants) along the US-Mexico border. These maquiladoras are factories in Mexico that assemble or manufacture products that are subsequently exported back to the US. Before the implementation of the North American Free Trade Agreement (NAFTA), these products were imported into the U.S. with Customs duty assessed only on the value added in Mexico. Today, several of the finished products produced by the maquiladoras qualify for duty-free treatment under the United States-Mexico-Canada Agreement (USMCA). This program capitalized on Mexico’s lower labor costs to assemble products for export to the United States. In addition, maquiladoras are exempt from the Mexican 16% value-added tax on raw materials.

NAFTA and USMCA

The 1994 ratification of the North American Free Trade Agreement (NAFTA) further integrated and grew the manufacturing sector in the United States and Mexico. By removing tariffs on products that crossed the border, NAFTA reshaped both economies by providing economic opportunities in Mexico and enhancing the competitiveness of U.S. companies. In 2018, calls for modernization and renegotiation of NAFTA led to the creation of the USMCA which took effect in July 2020. This renegotiation modified various aspects of the trade agreement. For example, re-defining the automotive manufacturing industry’s labor content agreements and minimum wages.

Wages

The manufacturing sector contributes significantly to the economies of the United States and Mexico. In addition, this sector is a major source of job creation for both countries. In the United States, 12.7 million people were employed in manufacturing in 2022, approximately 1 in every 13 American workers. In Mexico, 9.5 million were employed in manufacturing in 2022, approximately 1 in every 7 workers. Currently, there is a major disparity in wages between the two countries.

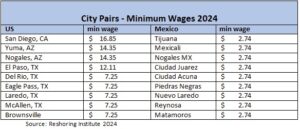

In March 2024, the average salary for manufacturing workers in the United States was $27.50/hour compared to $4.50/hour for Mexican manufacturing workers. There is even a bigger disparity in the wages in border towns. This chart shows the wage comparison in city pairs at the border.

In March 2024, the average salary for manufacturing workers in the United States was $27.50/hour compared to $4.50/hour for Mexican manufacturing workers. There is even a bigger disparity in the wages in border towns. This chart shows the wage comparison in city pairs at the border.

The Future of Manufacturing in the U.S. and Mexico

The future of the manufacturing industry in the United States and Mexico is positioned for a significant transformation driven by the rise of nearshoring, industry 4.0, and the 2026 USMCA renegotiation. Nearshoring (companies relocating production closer to the U.S. to reduce supply chain risks, costs, and environmental impact) benefits the Mexican manufacturing industry given its geographical proximity and established manufacturing infrastructure near the U.S. In addition, Industry 4.0, characterized by integrating digital technologies such as artificial intelligence (AI), digital technologies, 3D printing, IoT, and advanced robotics, is revolutionizing manufacturing processes. These innovations enable more efficient operations creating new opportunities for both countries to remodel their manufacturing industries.

Renegotiation of USMCA Finally, the scheduled renegotiation of the USMCA in 2026 presents challenges and opportunities. The renegotiation clause drew criticism when the U.S. proposed it during the 2018 negotiations but ultimately passed. The United States was the biggest proponent of the renegotiation, and will probably raise concerns on labor inequalities, the energy sector, and shifts in global supply chains. For Mexico’s new government, the renegotiation will attempt to maximize the nearshoring movement.

The manufacturing sector is essential to the economic well-being of both the United States and Mexico. Its continued development and adaptation to emerging trends will be key to sustaining and enhancing the economic partnership between these two nations.

About the Author

Daniel Domsky is a student studying Economics and International Relations at American University in Washington, DC. Originally from San Luis Potosí, Mexico, Daniel worked for over ten years traveling across villages and cities across central Mexico. With this experience, he saw firsthand how economic development and investment can improve the lives of millions.

Over his academic career, Daniel has focused his studies on issues surrounding supply chain shifts, transnational migration, and economic development. Daniel has previously held internships at the Embassy of Mexico in the United States and at the Democratic National Committee.