Industrial Park Development in Mexico

By Daniel Domsky

Industrial park development is the central strategy to bolster the manufacturing industry in Mexico. Mexican President, Claudia Sheinbaum, pledged to build 100 new industrial parks by the end of her six-year administration. Currently, 92 industrial parks are under construction, with an estimated new 40.5 billion dollars in investment in 2024, Jorge Avalos Carpinteyro, president of the Mexican Association of Industrial Parks (AMPIP), said. Driven by nearshoring trends, competitive labor costs, and the United States-Mexico-Canada Agreement (USMCA), these parks are transforming Mexico into a vital and modern hub for manufacturing and logistics. Companies, particularly those shifting supply chains away from China, Japan, India, South Korea, and the U.S. , are increasingly drawn to Mexico’s position in the North American market.

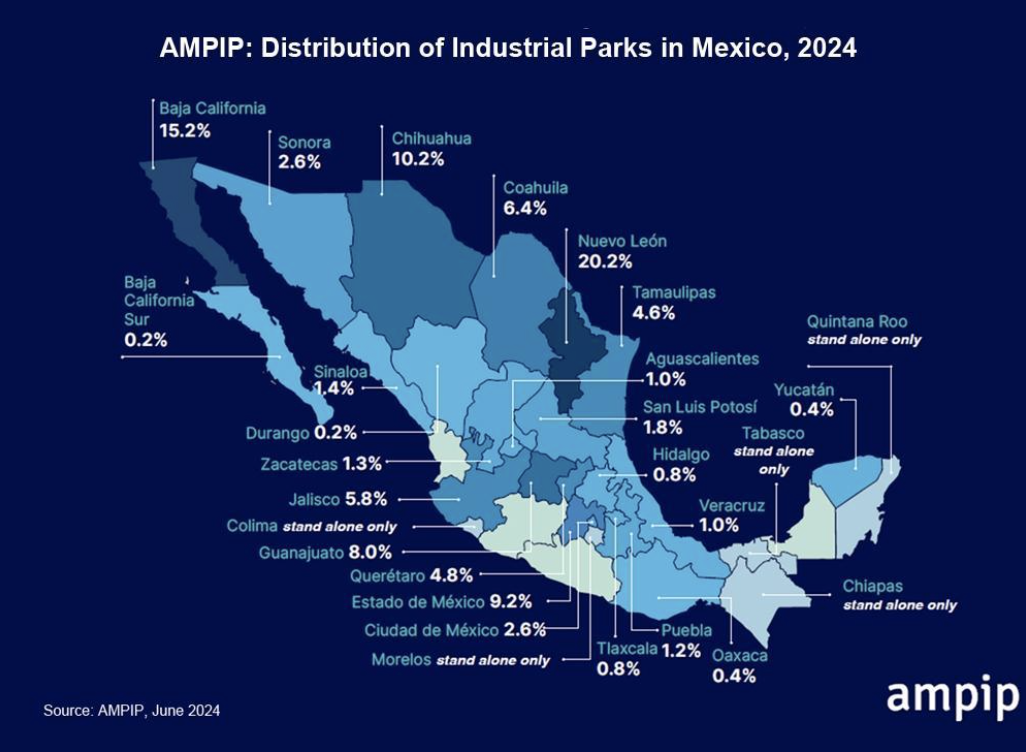

Industrial parks are designated areas developed specifically for industrial and manufacturing activities. These parks often cluster industries and regions to maximize efficiency and reduce operational costs. In Mexico, there are over 430 industrial parks spread out across 27 states, according to (AMPIP). With over 38 million square meters of buildings, 62% of the over 3,700 tenants are foreign companies. Because of the proximity to American markets, the highest concentration of industrial parks is in the Northeast and Center regions of Mexico. Following the aftermath of the US-China trade war and the post-pandemic supply shifts, demand for these industrial parks has risen with over 20% of foreign firms entering Mexico of Asian origin, according to BBVA research.

Creating industrial parks doesn’t come without issues, most notably energy distribution and real estate access. The Manufacturing industry consumes nearly 60% of the power generated in Mexico, with demand only increasing according to Salvador Portillo, president of the National Chamber of Electrical Manufacturers.

This influx of trade has specific rules and regulations, particularly when importing Mexican products into the U.S.. Product content percentage plays a critical role in manufacturing and international trade, as it determines whether goods meet the requirements for preferential treatment under trade agreements. Under USMCA, rules of origin specify that a certain percentage of a product’s components and raw materials, plus value added from production, must originate from member countries to qualify for reduced tariffs or duty-free access. These rules require goods to meet one of four origin criteria: wholly obtained or produced, exclusively from originating materials, product-specific rules of origin (PSROs), or disassembled goods. Each criterion ensures that a substantial portion of the product’s value is generated within North America. For example, PSROs use methods such as tariff shifts to a new product classification, regional value content, or substantial transformation processes to assess the Country of Origin of a product. . This means that Mexican companies may not import kits or parts from another country such as China, assemble the parts in Mexico, and declare the origin as Mexico unless the product has been substantially transformed into an entirely new product. There are no legal ways to avoid the U.S. Customs requirements for Country of Origin.

President-Elect Donald Trump recently suggested raising tariffs on imports from Mexico. The imposition of these new tariffs on Mexico’s industrial sector could significantly affect its competitiveness and the attractiveness of its industrial parks, given the nation’s deep integration with U.S. supply chains. Using the automotive industry as an example, each vehicle produced under the USMCA framework has parts that cross the border an average of eight times during production, meaning the tariffs would be compounded at each stage, according to Brookings. Whether or not the threatened 10% tariff on Mexican goods would be legal under USMCA is unknown.

Mexico’s ambitious plan to continue developing new industrial parks underscores its commitment to solidifying its role as a global manufacturing hub amidst a world of shifting supply chains. Some say Mexico is becoming the “New China.” This change is not without challenges. Increased demand for energy distribution, real estate access, and compliance with complex trade regulations like USMCA’s rules of origin must be navigated carefully to sustain growth. Finally, with rising geopolitical tensions and potential tariff threats, Mexico’s industrial sector stands at a crossroads, waiting for its largest bilateral trading partner to make sound policy choices, not just rhetoric and threats, to determine its long-term competitiveness and economic resilience.

1 https://expansion.mx/economia/2024/10/17/construir-100-parques-industriales-sheinbaum

2 https://t21.com.mx/en-construccion-92-de-los-100-parques-industriales-de-sheinbaum-ampip/

3 https://research.hktdc.com/en/article/MTgzODg1NTUyMQ#:~:text=As%20of%20June%202024%2C%20there,of%20manufacturing%20facilities%20in%20Mexico

4 https://www.ampip.org.mx/pdf/brief/es/Mexico-en-Breve-2023-AMPIP.pdf

5 https://www.bbvaresearch.com/en/publicaciones/mexico-nearshoring-outlook-mexicos-industrial-parks-association-survey/

6 https://mexiconewsdaily.com/business/investment-industrial-parks-mexico/

7 https://ustr.gov/sites/default/files/files/agreements/FTA/USMCA/Text/04-Rules-of-Origin.pdf

8 https://mitchelltrade.com/article/determining-origin-under-the-usmca

9 https://economictimes.indiatimes.com/markets/commodities/news/how-trumps-proposed-tariffs-might-affect-commodities-and-energy/articleshow/115714089.cms?from=mdr

10 https://www.brookings.edu/articles/the-consequences-of-trumps-tariff-threats/